Home First Time Buyer Buying A Home Mortgage Mortgage Refinance Govoernment Programs FHA Refinance Home Affordable Refinance Program or HARP Reverse Mortgage Mortgage Refinancing Advice 12 Common Mistakes Home Buyers Make HARP Refinance Conventional Refinance Cash-Out Refinance USDA Streamline Refinance VA Streamline Refinance Is Life Insurance Compulsory for Mortgage? 9 Tips for Applying Mortgage Credit Good Time to Buying A House Select Your Mortgage

The basics of a mortgage

What is a mortgage?

Your purchase of a home will be among the largest, most important purchases you'll make in your life. There are few things which cost as much; and, few things which will affect your life as much, either.

As a first-time home buyer, therefore, it's important to have a feel for how the home buying process works, and what you should expect from your mortgage.

Your mortgage is the loan you will use to buy your home.

Mortgages are similar to other loans in that there is some amount borrowed; a rate of interest paid to the lender; and, a pre-determined number of years over which the loan must be repaid.

The key part of a mortgage that makes it different from other loan types is that a mortgage loan is specifically used for the purchase of real estate. Also, mortgages can be customized.

There are a bevy of loan programs available for today's home buyers including low- and zero-downpayment loans; loans for buyers of condominiums; and, loans for members of the U.S. military, as examples.

With the help of your mortgage lender, you'll build the loan that best fits your needs.

Why do home buyers use mortgages?

Buying a home ain't cheap.

No matter the price tag, few first-time home buyers have cash on-hand to purchase a home outright. And, those that do have the cash often prefer to keep their cash money for other things in their life.

When you buy a home, then, it's likely that you'll seek a loan from a bank.

A loan used to buy real estate is known as a mortgage.

With a mortgage, the home buyer borrows money from a lender. Those monies are then used to purchase a portion of the home. The remaining portion of the home purchase is paid by the buyer.

For example, if the buyer purchases a home for $300,000 and the mortgaged amount is $270,000, the home buyer is responsible for bringing the remaining $30,000 to closing.

This $30,000 is known as the "down payment". The remaining monies are now mortgaged to the bank, with terms which are customizable between the bank and the borrower.

And, just like every home buyer is different, every mortgage is different, too. Your loan terms are entirely up to you.

How do I qualify for a mortgage?

To qualify for a mortgage, you must meet the minimum standards of whichever loan type you determine is best for needs.

There are tens of available loan types, but the four most common are all U.S. government-backed.

The four government-backed loan types are the conventional mortgage, the VA mortgage, the FHA mortgage, and the USDA mortgage.

Each of the loan types are different, with different qualification standards, the steps to get mortgage-qualified are similar among the four programs.

First, you will need to meet a minimum credit score requirement. This requirement is lowest for FHA home loans; and, roughly equal among the remaining three programs.

Next, you will be asked to verify your income using W-2s, pay stubs, and federal income tax returns. Your debts will be verified, too, using a recent copy of your credit report.

If your credit report happens to include errors or omissions, which sometimes happens, you can provide documentation to your lender to correct such mistakes.

Your lender will also want to verify your employment history and your savings.

How large should my down payment be?

When you’re buying a home, the amount of money you bring to closing is known as your down payment.

You can think of your downpayment as the part of the home purchase price that you’re not borrowing from the bank.

Depending on which loan program you choose to use, your minimum downpayment will vary.

- VA loan: 0% down payment required

- USDA loan: 0% down payment required

- Conventional loan: 3% down payment required

- FHA loan: 3.5% down payment required

Keep in mind these figures are just minimums. You can choose to make a larger down payment, if you want.

When you make a larger down payment, your monthly payment is reduced because you're borrowing less money. And, if you use a conventional loan -- which many home buyers do -- larger down payments are linked to lower mortgage rates.

What will my mortgage interest rate be?

Your mortgage interest rate is "made" in two parts and there's a science that determines what rate you get from the bank.

The first part of your mortgage rate is linked to your loan program.

Of the four government-backed loan programs, VA mortgage rates are often the cheapest, beating conventional mortgage rates by as much as 40 basis points (0.40%), followed closely by USDA mortgage rates.

Next come FHA mortgage rates, followed by conventional rates.

FHA mortgage rates tend to beat conventional mortgage rates by 15 basis points (0.15%) or so, and this may look like a better deal, but price gains made on an FHA mortgage rate can be quickly gobbled up by the cost of FHA mortgage insurance.

Your lender can help you compare the relative value of an FHA loan as compared to a conventional one.

Now, once you've selected your loan type and have been assigned a "base" mortgage rate, it's up to you whether you want to accept it.

Here how it works:

- Your lender quotes you a rate on your loan. Your loan requires closing costs.

- If you want a lower mortgage rate, you can opt to pay additional closing costs.

- If you want fewer closing costs, you can opt to accept a higher mortgage rate.

In this way, you can do a "zero-closing cost" mortgage. As the home buyer, you ask your lender to reduce your loan closing costs and your lender obliges in exchange for a slight increase to your mortgage rate.

In general, for loan sizes of $250,000 or more, you can get a zero-closing cost mortgage in exchange for a mortgage rate increase of 25 basis points (0.25%).

How long do I have to pay back my loan?

As the mortgage borrower, the term of your loan is also up to you. A loan "term" is the number of years until the loan must be paid-in-full.

The most common loan term for mortgage loans is 30 years. However, there are other options, too, including a 10-year term, a 15-year term, a 20-year term, and a 25-year term.

The benefits of a shorter-term loan is that your mortgage rate is typically lower, plus your loan gets paid off sooner.

These factors reduce the long-term interest costs of owning a home so, with a shorter-term loan, it actually costs less to "buy" the home you’re buying.

However, there are reasons to choose a longer-term loan, too. Namely, because mortgage repayment gets spread over a larger number of years, each payment is smaller as compared to the payment with a shorter-term loan.

The payment on a 30-year mortgage can be one-third less than the payment for a comparable 15-year term.

What will my monthly mortgage payment be?

Your monthly mortgage payment is a function of three things: the amount of money you've borrowed, your mortgage interest rate, and your loan term.

For borrowers using a fixed-rate mortgage, you can plug the above three figures into a mortgage calculator to calculate your monthly payment; and, you'll know that the payment will be unchanged so long as the loan is in effect.

This is because fixed-rate mortgages are mortgage loans for which the interest rate does not change -- even if market mortgage rates move higher or lower in the future.

Indeed, this is part of the appeal of a fixed-rate loan -- you know exactly what your payment will be each month, which make it simpler to budget for homeownership.

The opposite of a fixed-rate mortgage is an adjustable-rate mortgage (ARM). With an adjustable-rate mortgage, your mortgage rate -- and, therefore, your mortgage payment -- is subject to change.

With an adjustable-rate mortgage, your loan’s interest rate remains unchanged for a number of years, and then can vary during the remaining term of the loan.

The most common "teaser" periods for adjustable-rate loans are 5 years and 7 years. After this period ends, ARM mortgage rates can change up to once per year.

ARMs can adjust higher, but they can also adjust lower, too. Downward adjustments are common during periods of economic weakness and uncertain growth.

Since 2003, home buyers with ARMs have routinely "beat the market".

What are today's mortgage rates?

As a first-time home buyer, understanding how your mortgage works is the first step to making better mortgage choices -- and getting the best rate possible.

Get today's live mortgage rates now. Your social security number is not required to get started, and all quotes come with access to your live mortgage credit scores.

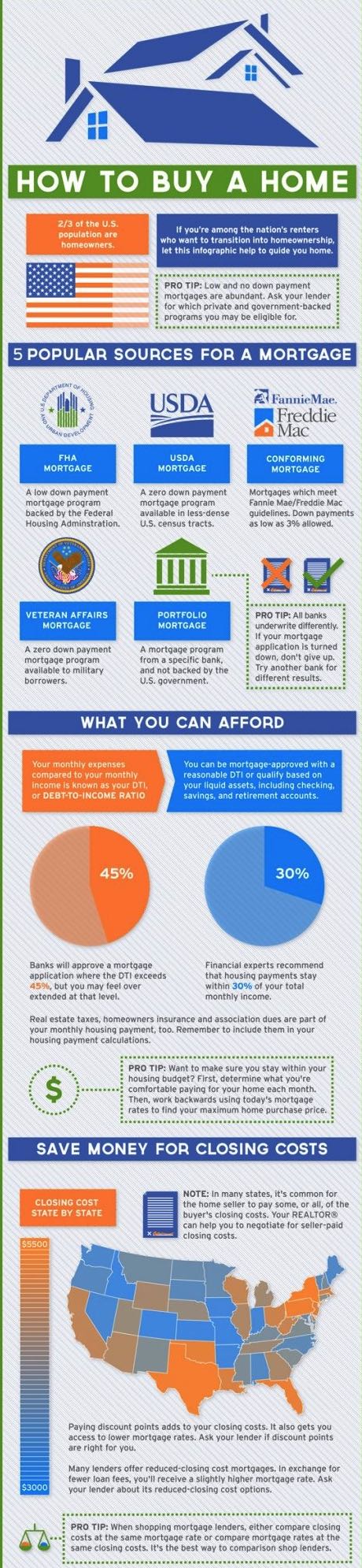

How To Buy A Home (Infographic)

What kind of loan program is best for you?

Fixed Rate Mortgages (FRM)

Adjustable Rate Mortgages (ARM)

Hybrid ARMs (3/1 ARM, 5/1 ARM, 7/1 ARM, 10/1 ARM)

HARP 2.0

FHA Loans

VA Loans

Interest Only Mortgages

Components of an ARM

Commonly Used Indexes for ARMs

Balloon Mortgages

Reverse Mortgages

Graduated Payment Mortgages

When (And When Not) to Refinance Your Mortgage

Refinancing a mortgage means paying off an existing loan and replacing it with a new one. There are many reasons why homeowners refinance: the opportunity to obtain a lower interest rate; the chance to shorten the term of their mortgage; the desire to convert from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage, or vice versa; the opportunity to tap a home's equity in order to finance a large purchase; and the desire to consolidate debt. Some of these motivations have benefits and pitfalls. And because refinancing can cost 3% to 6% of the loan's principal and – like taking out the original mortgage –requires appraisal, title search and application fees, it's important for a homeowner to determine whether his or her reason for refinancing offers a true benefit.

Securing a Lower Interest Rate

One of the best reasons to refinance is to lower the interest rate on your existing loan. Historically, the rule of thumb was that it was worth the money to refinance if you could reduce your interest rate by at least 2%. Today, many lenders say 1% savings is enough of an incentive to refinance.

Reducing your interest rate not only helps you save money, it also increases the rate at which you build equity in your home, and it can decrease the size of your monthly payment. For example, a 30-year fixed-rate mortgage with an interest rate of 9% on a $100,000 home has a principal and interest payment of $804.62. That same loan at 6% reduces your payment to $599.55.

Shortening the Loan's Term

When interest rates fall, homeowners often have the opportunity to refinance an existing loan for another loan that, without much change in the monthly payment, has a significantly shorter term. For that 30-year fixed-rate mortgage on a $100,000 home, refinancing from 9% to $5.5% cuts the term in half to 15 years, with only a slight change in the monthly payment from $804.62 to $817.08.

Converting Between Adjustable-Rate and Fixed-Rate Mortgages

While ARMs often start out offering lower rates than fixed-rate mortgages, periodic adjustments often result in rate increases that are higher than the rate available through a fixed-rate mortgage. When this occurs, converting to a fixed-rate mortgage results in a lower interest rate and eliminates concern over future interest rate hikes.

Conversely, converting from a fixed-rate loan to an ARM can also be a sound financial strategy, particularly in a falling interest rate environment. If rates continue to fall, the periodic rate adjustments on an ARM result in decreasing rates and smaller monthly mortgage payments, eliminating the need to refinance every time rates drop.With mortgage interest rates rising, on the other hand, as they have begun to do, this would be an unwise strategy.

Converting to an ARM, which often has a lower monthly payment than a fixed-term mortgage, may be a good idea for homeowners who don't plan to stay in their home for more than a few years. If interest rates are falling, these homeowners can reduce their loan's interest rate and monthly payment, but they won't have to worry about interest rates rising in the future.

Tapping Equity and Consolidating Debt

While the previously mentioned reasons to refinance are all financially sound, mortgage refinancing can be a slippery slope to never-ending debt. It's important to keep this in mind when considering refinancing for the purpose of tapping into home equity or consolidating debt.

Homeowners often access the equity in their homes to cover major expenses, such as the costs of home remodelling or a child's college education. These homeowners may justify such refinancing by pointing out that remodelling adds value to the home or that the interest rate on the mortgage loan is less than the rate on money borrowed from another source. Another justification is that the interest on mortgages is tax deductible. While these arguments may be true, increasing the number of years that you owe on your mortgage is rarely a smart financial decision, nor is spending a dollar on interest to get a 30-cent tax deduction.

Many homeowners refinance to consolidate their debt. At face value, replacing high-interest debt with a low-interest mortgage is a good idea. Unfortunately, refinancing does not bring with it an automatic dose of financial prudence. Take this step only if you are convinced you'll be able to resist the temptation to spend once the refinancing gets you out from under debt. Be aware that a large percentage of people who once generated high-interest debt on credit cards, cars and other purchases will simply do it again after the mortgage refinancing gives them the available credit to do so. This creates an instant quadruple loss composed of wasted fees on the refinancing, lost equity in the house, additional years of increased interest payments on the new mortgage and the return of high-interest debt once the credit cards are maxed out again – the possible result is an endless perpetuation of the debt cycle and eventual bankruptcy.

The Bottom Line

Refinancing can be a great financial move if it reduces your mortgage payment, shortens the term of your loan or helps you build equity more quickly. When used carefully, it can also be a valuable tool in getting debt under control. Before you refinance, take a careful look at your financial situation and ask yourself: How long do I plan to continue living in the house? And how much money will I save by refinancing?

Again, keep in mind that refinancing costs 3% to 6% of the loan's principal. It takes years to recoup that cost with the savings generated by a lower interest rate or a shorter term. So, if you are not planning to stay in the home for more than a few years, the cost of refinancing may negate any of the potential savings. It also pays to remember that a savvy homeowner is always looking for ways to reduce debt, build equity, save money and eliminate that mortgage payment. Taking cash out of your equity when you refinance doesn't help you achieve any of those goals.